We Help Struggling Traders

Fill The Consistency Gap and Reach Profitability—Faster

... Minus The Emotional Rollercoaster And Financial Drain

Discover how we turn struggling traders into profitable ones

by instilling in them the consistency needed to thrive in the market

through the Consistent Trader Program (CTP).

Our Mission

We help struggling traders trade their strategy with composure for consistent profits by having them develop and sustain behavioral consistency.

We only work with committed traders, and we know that we are successful when our clients are able to sustain their results and progress well after our work with them is over.

Trading is predominantly a mental game. By helping our clients get proven results, our overarching objective is to elevate the success rate among traders, which is currently abysmal.

We want to impact more and more people, positioning our 'Trading Composure' solutions as an indispensable component of every trader's journey toward consistency and success.

What is Trading Composure?

We're the leading trading psychology coaching company for serious traders who want more consistency, more composure, more income, more independence, and more freedom…

The company was founded in 2014 by seasoned trader and trading psychology consultant Yvan Byeajee, who co-manages a multiple eight-figure fund and has helped thousands of traders win the mental game of trading.

Our trading psychology solutions (offered through our flagship program, the CTP) are designed to help struggling traders bridge the consistency gap in their trading.

The consistency gap is the contrast between what a trader knows they should do and what they end up doing as they get swayed by emotional impulses in the heat of trading.

Our solutions WORK! We’ve helped countless traders bridge this so-called consistency gap and achieve consistent profitability in their trading—in record time.

We assist clients at every experience level, regardless of their trading style or approach. Our focus is on cultivating and maintaining behavioral consistency, a crucial factor that leads to consistent profits.

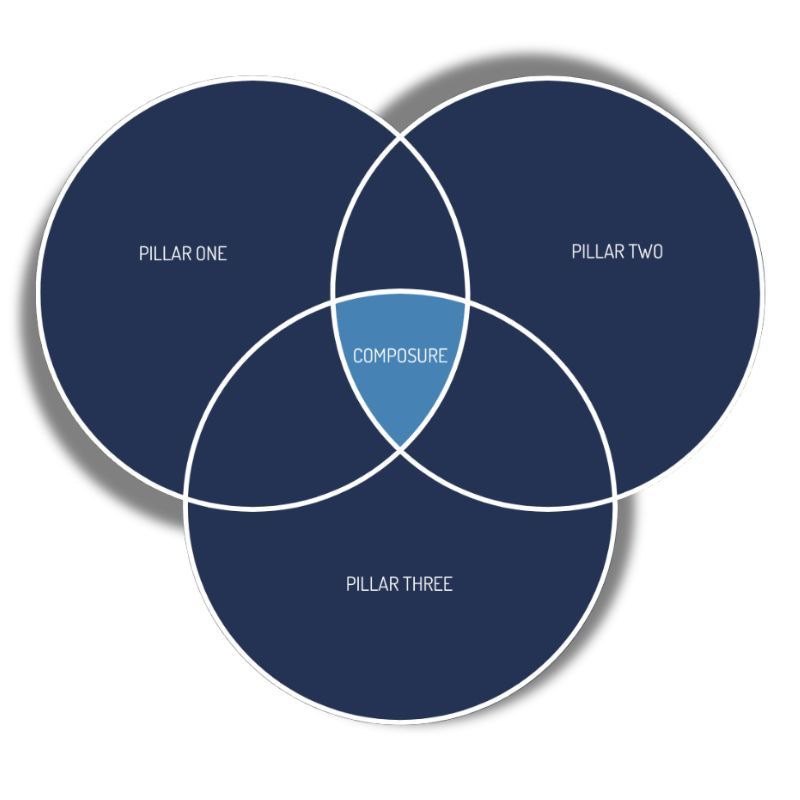

We Help Traders Master

Three Key Pillars of Successful Trading

- PILLAR ONE - The paradigm-shifting perspective that revolutionizes your market understanding

- PILLAR TWO - The crucial component that bolsters your emotional composure

- PILLAR THREE - The essential connector that binds everything together, taking your trading to new heights

Find out what these pillars are ⤸

Can You Relate?

EMOTIONS RULE YOUR TRADING!

Winning trades give you a buzz and losing trades make you depressed.

You keep making the same mistakes…

… and it often feels like you’re taking one step forward and two steps back.

You’ve tried everything—you’ve read a ton of books, taken courses, started journaling and meditating… but nothing has effectively anchored you on the trading consistency path.

If you can relate, know that you’re NOT alone! And, we can probably help! We've done it MANY times before—we’ve helped struggling traders COMPLETELY turn their results around.

The Truth About The Trading World

If you’re like most traders we work with, you’re great at reading charts. However, you’re probably not as savvy when it comes to consistency and composure.

The truth is that most trading education systems help you become a great “technician” but do very little to help you succeed in ACTUAL trading. It’s a lot of theory but very little do-ing!

We help our clients fill this critical gap by providing personalized coaching that emphasizes the practical application and refinement of trading skills in real market conditions.

Our most successful clients are those who recognize that their successes outside of trading don’t entitle them to success in trading. They understand the need to learn the next crucial skill set in their journey—trading composure. And that’s why they turn to us.

With our support, traders translate theory into practice and achieve sustained results in their trading journey.

Can This Work For You?

Discover how we transformed the trading journeys of hundreds of traders, instilling in them the consistency needed to thrive in the market through the Consistent Trader Program (CTP), our famous trading psychology method.

WATCH THE TRAINING